In a sector where trust and reputation are key currencies, link building has become an indispensable ally for financial entities. This article unpacks how digital strategies, from guest blogging to online public relations, not only enhance the visibility and authority of these institutions but also face challenges. With a focus on quality over quantity, link building promises to be a crucial tool in the evolution of finance’s online presence, adapting to an increasingly digital and competitive world.

The impact of link building in the financial sector

In the financial sector, link building is crucial to improve visibility and strengthen the reputation of entities, optimizing SEO and building trust and authority.

Digital authority and trust

The concept of Domain Authority (DA) is a central pillar in the digital presence of financial entities. Gaining quality links from respected sources significantly contributes to increasing this authority, reinforcing the perception of reliability among clients and search engines. These links act as votes of confidence, essential in a sector where authenticity and security are paramount. According to studies, sites with a higher number of quality links tend to occupy privileged positions in search results, increasing their visibility and credibility.

Digital trust enhances the entity’s recognition, increasing the likelihood of customer choice. Link building improves positioning and establishes trust with users, key factors for success in the competitive financial market.

Link building strategies tailored to finance

| Strategy | Description | Benefits |

|---|---|---|

| Guest blogging | Collaborate with external platforms by sharing knowledge | Generates valuable links, strengthens brand, expands reach |

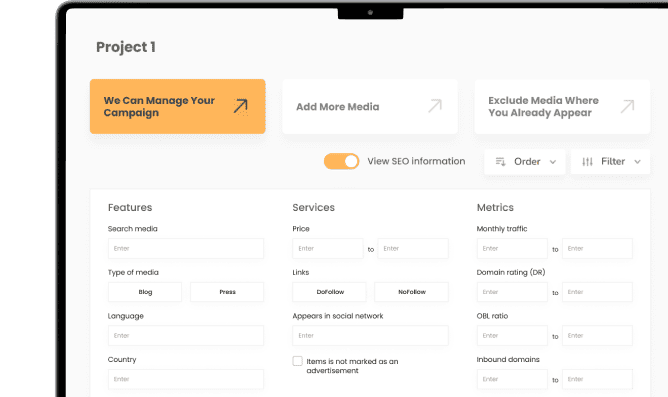

| Use of Growwer | Use of a tool to automate online reputation and link building | Optimizes link acquisition, ensures quality and relevance |

| Recovery of lost links | Identifying and replacing broken links | Improves user experience, quality backlinks |

| Digital public relations | Connections with journalists and influencers | Generates mentions and links, strengthens credibility |

| Internal link structure | Optimizes internal link structure | Improves navigation, distributes authority, enhances SEO |

| Inclusion in financial directories | Presence in prestigious financial directories | Increases visibility, reinforces local presence |

Guest blogging, strategic collaborations, and use of Growwer

Guest blogging allows financial entities to collaborate externally, generating valuable links and strengthening the brand. Using Growwer optimizes link acquisition, ensuring quality and relevance with over 30,000 media outlets.

This strategy not only generates quality backlinks but also diversifies communication channels, expanding the entity’s presence and facilitating access to new audiences and business opportunities. By sharing specialized knowledge on renowned platforms, financial entities position themselves as experts in their field.

Recovery of lost links

Recovering lost links involves identifying and replacing broken links on financial websites. This process is essential to improve user experience and acquire quality backlinks. Meticulous search and effective communication with webmasters for replacement are key to maintaining the website’s integrity.

A practical example of this strategy is when a financial institution discovers that several of its most popular articles have broken links. By identifying these errors and contacting webmasters to fix them, the institution not only improves its search engine positioning but also strengthens user trust, ensuring the provided information is accurate and accessible.

Digital public relations

Digital public relations are key in finance for connecting with journalists and influencers, generating mentions and links that reinforce credibility. Providing relevant content and collaborating with influencers broadens brand reach, consolidating reputation and visibility.

This strategy allows financial entities to participate in relevant sector conversations, positioning themselves as authoritative voices on financial topics. By cultivating relationships with specialized media and sector influencers, entities can spread their message more effectively and build a solid digital presence.

Internal link structure

Optimizing the internal link structure improves user experience and site SEO, facilitating navigation and effectively distributing authority. This reduces search time for information and increases conversion rates.

A well-planned internal link structure helps users easily find the information they seek, while efficiently distributing page authority. This not only enhances user experience but also increases site dwell time and reduces bounce rate, critical factors for SEO.

Inclusion in financial directories

Being present in prestigious financial directories offers multiple advantages for entities in the sector. It not only provides quality links but also increases visibility in sector-specific searches. Inclusion in these directories strengthens local presence and enhances the reputation of the entity among users seeking reliable financial services.

To maximize the benefits of this strategy, it is essential to carefully select appropriate directories and optimize listings. Ensuring that the information is clear and accurate not only improves SEO but also builds user trust, translating into greater brand recognition in the financial sector.

Challenges of link building in the financial sector

| Challenge | Description | Solution |

|---|---|---|

| Regulatory and ethical compliance | Regulations and ethics in link building | Effective strategies that comply with regulations |

| Prioritizing quality | Avoiding questionable tactics | Focus on link quality |

Regulatory and ethical compliance

The financial sector faces unique challenges regarding regulations and ethics. Link building strategies must be effective and comply with current regulations. Maintaining brand integrity while navigating this complex regulatory environment is crucial to ensuring customer trust and avoiding penalties.

Financial entities must be transparent in their practices, ensuring all tactics used are ethical and comply with applicable laws. This not only protects the brand’s reputation but also guarantees sustainable long-term growth, avoiding legal and financial risks.

Prioritizing quality over quantity

In a sector where trust is paramount, it is essential to avoid questionable link building tactics. Prioritizing quality over quantity of links is fundamental to establishing a solid foundation for online authority growth. Creating valuable content that naturally attracts links should be the priority for financial entities.

This sustainable approach not only enhances SEO but also strengthens user trust in the entity. By focusing on quality, companies can build long-term relationships with their audiences, ensuring strong market positioning and reinforcing their digital reputation.

The future of link building in finance

Evolution and adaptation

Link building in the financial sector will continue to evolve, adapting to new technologies and user behaviors. Entities that can integrate these strategies ethically and effectively will be better positioned to stand out in an increasingly digital and competitive market.

Future trends indicate that the use of artificial intelligence and big data analysis will play an important role in personalizing and optimizing link building strategies. As users become more sophisticated in their digital interactions, financial entities must adapt and evolve to meet their changing expectations.

In conclusion, link building will remain a valuable tool for financial entities seeking to strengthen their online presence. Those who prioritize quality, ethics, and innovation will be better prepared to face future challenges and seize opportunities in the dynamic financial sector.